Wednesday the market didn’t tell us anything new. The equities market is still over extended on the daily chart but the market is refusing to break down. Each time there has been seen selling in the market over the past two weeks, the market recovers. Equities and the dollar have been trading with an inverse relationship and it seems to drop every in value each selling pressure enters the market, which naturally lifts stocks.

That being said, sellers are starting to come into the market at these elevated levels and it’s just a matter of time before we see a healthy pullback/correction. The past 10 session volatility has been creeping up as equities try to sell off. There will be a point when a falling dollar is not bullish for stocks but until then it looks like printing of money will continue devaluing of the dollar to help lift the stock market. Some type of pullback is needed if this trend is to continue and the markets can only be held up for so long.

Below is a chart of the USO oil fund and the SPY index fund. Crude has a tendency to provide an early warning sign for the strength of the economy. As you can see from the April top, oil started to decline well before the equities market did. This indicated a slow down was coming.

The recent equities rally which started in late August has been strong. But take a look at the price of oil. It has traded very flat during that time indicating the economy has not really picked up, nor does it indicate any growth in the coming months. This rally just may be coming to an end shortly.

This daily chart of the SP500 fund shows similar topping patterns. This looks to be the last straw for the SP500. Most tops occur with a gap higher or early morning rally reaching new highs, only to see a sharp sell off by the end of the session which generates a reversal day. From the looks of this chart that could happen any day.

In short, volume overall in the market remains light which is why we continue to see higher prices. Light volume typically gives the stock market a positive bias while Sell offs require strong volume to move lower. That being said every dip in the equities market which has been close to a breakdown seems to get lifted back up by a falling dollar, but that can only happen for so long because one the volume steps back into the market the masses will be in control again.

You can get my ETF and Commodity Trading Signals if you become a subscriber of my newsletter. These free reports will continue to come on a weekly basis; however, instead of covering 3-5 investments at a time, I’ll be covering only 1. Newsletter subscribers will be getting more analysis that’s actionable. I’ve also decided to add video analysis as it allows me to get more info across to you quicker and is more educational, and I’ll be covering more of the market to include currencies, bonds and sectors. Before everyone’s emails were answered personally, but now my focus is on building a strong group of traders and they will receive direct personal responses regarding trade ideas and analysis going forward. Due to more analysis and that I want to keep the service personal the price of the service will be going up Oct 1st, so join today.

Let the volatility and volume return!

Chris Vermeulen

The Gold And Oil Guy.Com

Get More Free Reports and Trade Ideas Here for Free: FREE SIGN-UP

Share

Thursday, September 30, 2010

Sunday, September 26, 2010

SP500 Internals, Dollar & Gold Pre-Week Analysis

From Chris Vermuelen.....The Gold and Oil Guy

After a fierce equities rally on Friday, which I figured would happen, just not that strong; I have to wonder if there is some event or major decision in the works we don’t know about?

Friday’s rally could be something simpler like window dressing by the funds. This is when the funds buy up all the top performing stocks for month end reporting. They do this so that their investors think they are on the ball and know what they are doing. Window dressing will end Monday and from there we could see some profit taking (selling) start. But for all we know Obama could be extending the tax cuts for everyone or cutting payroll taxes etc…

It would only take one of these events to trigger a sharp up move in the market and that could be what Friday’s move was anticipating. That being said volume has remained light and during low volume session the market has a tendency to move higher. Sell offs in the market require strong volume to pull the market down, so until volume picks up there could still be higher prices just around the corner.

Let’s take a look at some charts…

SPY – SP500 60 Minute Intraday Chart

Last week we saw the market reverse to the down side with a strong end of say sell off. That set the tone for some follow through selling and for any bounces to be sold into. That being said, the market always has a way of surprising traders and it did just that on Friday gapping above Thursday’s reversal high causing shorts to cover and the typical end of week light volume drift to help hold prices up.

NYSE Market Internals – 15 Minute Chart

I like to follow some market internals to help understand if investors are becoming fearful or greedy. It also helps me gauge if the market is over bought or oversold on any given day.

These three charts below show some interesting data.

Top Chart – This indicator shows me if the majority of shares traded are bought or sold. When the red line spikes up and trades above 5 then I know the majority of traders are buying over covering their shorts. I call this panic buying because traders are buying in fear that the market will continue higher and they will miss the train. When everyone is buying you know a pullback is most likely to occur.

Middle Chart – This is the NYSE advance/decline line. When this indicator is below -1500 then the market is over sold and bottom pickers/value buyers will step in and nibble at stocks. But when this indicator is trading over 1500 then you know the market is overbought and there should be some profit taking starting any time soon.

Bottom Chart – This is the put/call ratio and this tells us how many people are buying calls vs put options. When this indicator is below 0.80 level more traders are bullish and buying leverage. My theory is if they are buying leverage for higher prices, then they have already bought all their stocks and now want to add some leverage for more profits. When I see the majority of traders bullish then I an sure to tighten my stops (if long) as top my be forming.

Putting the charts together – When each of these charts are trading in the red zone know I must be cautious for any long positions because the market just may be starting to top. Or a short term correction may occur.

UUP – US Dollar Daily Chart

The US dollar has been under some serious pressure with all the talk about quantitative easing (printing money). Obviously the more the Fed’s print the less value the dollar will have. The chart below shows a green gap window which I think once it is filled should put the dollar in a oversold condition for a short term swing trade bounce before heading back down. A bounce in the dollar will put pressure on equities, gold and oil.

GLD – Gold Daily Chart

Gold continues to grind its way up. This move is looking very long in the teeth and pullback will most likely be sharp.

Weekend Trading Conclusion:

In short, equities and gold continue to grind their way higher while the US dollar continues its grind lower. When I say the market is grinding I am implying the market is over extended and a reversal any day should occur.

Financial stocks like Goldman (GS) which typically leads the market has been strongly underperforming over the past week. Insiders were selling GS very strongly which is strange and makes me wonder what’s up there? With the financial stocks underperforming it sure looks like a market reversal is just around the corner.

If Friday’s rally was simply window dressing by the funds then it should end on Monday and with any luck we will see a sharp reversal to the down side early this week.

You can get my ETF and Commodity Trading Signals if you become a subscriber of my newsletter. These free reports will continue to come on a weekly basis; however, instead of covering 3-5 investments at a time, I’ll be covering only 1. Newsletter subscribers will be getting more analysis that’s actionable. I’ve also decided to add video analysis as it allows me toe get more into across to you quicker and is more educational, and I’ll be covering more of the market to include currencies, bonds and sectors. Before everyone’s emails were answered personally, but now my focus is on building a strong group of traders and they will receive direct personal responses regarding trade ideas and analysis going forward.

Let the volatility and volume return!

Chris Vermeulen

The Gold and Oil Guy .com

Get More Free Reports and Trade Ideas Here for Free: FREE SIGN UP

Share

After a fierce equities rally on Friday, which I figured would happen, just not that strong; I have to wonder if there is some event or major decision in the works we don’t know about?

Friday’s rally could be something simpler like window dressing by the funds. This is when the funds buy up all the top performing stocks for month end reporting. They do this so that their investors think they are on the ball and know what they are doing. Window dressing will end Monday and from there we could see some profit taking (selling) start. But for all we know Obama could be extending the tax cuts for everyone or cutting payroll taxes etc…

It would only take one of these events to trigger a sharp up move in the market and that could be what Friday’s move was anticipating. That being said volume has remained light and during low volume session the market has a tendency to move higher. Sell offs in the market require strong volume to pull the market down, so until volume picks up there could still be higher prices just around the corner.

Let’s take a look at some charts…

SPY – SP500 60 Minute Intraday Chart

Last week we saw the market reverse to the down side with a strong end of say sell off. That set the tone for some follow through selling and for any bounces to be sold into. That being said, the market always has a way of surprising traders and it did just that on Friday gapping above Thursday’s reversal high causing shorts to cover and the typical end of week light volume drift to help hold prices up.

NYSE Market Internals – 15 Minute Chart

I like to follow some market internals to help understand if investors are becoming fearful or greedy. It also helps me gauge if the market is over bought or oversold on any given day.

These three charts below show some interesting data.

Top Chart – This indicator shows me if the majority of shares traded are bought or sold. When the red line spikes up and trades above 5 then I know the majority of traders are buying over covering their shorts. I call this panic buying because traders are buying in fear that the market will continue higher and they will miss the train. When everyone is buying you know a pullback is most likely to occur.

Middle Chart – This is the NYSE advance/decline line. When this indicator is below -1500 then the market is over sold and bottom pickers/value buyers will step in and nibble at stocks. But when this indicator is trading over 1500 then you know the market is overbought and there should be some profit taking starting any time soon.

Bottom Chart – This is the put/call ratio and this tells us how many people are buying calls vs put options. When this indicator is below 0.80 level more traders are bullish and buying leverage. My theory is if they are buying leverage for higher prices, then they have already bought all their stocks and now want to add some leverage for more profits. When I see the majority of traders bullish then I an sure to tighten my stops (if long) as top my be forming.

Putting the charts together – When each of these charts are trading in the red zone know I must be cautious for any long positions because the market just may be starting to top. Or a short term correction may occur.

UUP – US Dollar Daily Chart

The US dollar has been under some serious pressure with all the talk about quantitative easing (printing money). Obviously the more the Fed’s print the less value the dollar will have. The chart below shows a green gap window which I think once it is filled should put the dollar in a oversold condition for a short term swing trade bounce before heading back down. A bounce in the dollar will put pressure on equities, gold and oil.

GLD – Gold Daily Chart

Gold continues to grind its way up. This move is looking very long in the teeth and pullback will most likely be sharp.

Weekend Trading Conclusion:

In short, equities and gold continue to grind their way higher while the US dollar continues its grind lower. When I say the market is grinding I am implying the market is over extended and a reversal any day should occur.

Financial stocks like Goldman (GS) which typically leads the market has been strongly underperforming over the past week. Insiders were selling GS very strongly which is strange and makes me wonder what’s up there? With the financial stocks underperforming it sure looks like a market reversal is just around the corner.

If Friday’s rally was simply window dressing by the funds then it should end on Monday and with any luck we will see a sharp reversal to the down side early this week.

You can get my ETF and Commodity Trading Signals if you become a subscriber of my newsletter. These free reports will continue to come on a weekly basis; however, instead of covering 3-5 investments at a time, I’ll be covering only 1. Newsletter subscribers will be getting more analysis that’s actionable. I’ve also decided to add video analysis as it allows me toe get more into across to you quicker and is more educational, and I’ll be covering more of the market to include currencies, bonds and sectors. Before everyone’s emails were answered personally, but now my focus is on building a strong group of traders and they will receive direct personal responses regarding trade ideas and analysis going forward.

Let the volatility and volume return!

Chris Vermeulen

The Gold and Oil Guy .com

Get More Free Reports and Trade Ideas Here for Free: FREE SIGN UP

Share

Thursday, September 23, 2010

SP500 Pierces, Bonds Rally, Dollars Fall Out the Window

From Chris Vermeulen at The Gold And Oil Guy.Com.......

It’s been a wild ride the past few days OptionsX, Obama and FOMC comments. Seems like everyone is waiting to see what the market is going to do going forward at this pivotal point…

Since the market topped in April and has since been trading sideways in this rather large range, everyone has small positions at work but waiting for a decisive move before fully committing to one side. There could be a few opportunities in the coming days using bonds, the dollar and the SP500 if all goes well which I explain below.

Lets take a look at the charts.....

SP500 – SPY ETF, Daily Chart

There has been a lot of talk about a sharp rally if the SP500 could break the 1130 level or the neckline everyone is talking about. Well this week Obama was on TV and the market rallied into that, then again after. I don’t really thing investors or traders were buying things up as he said the same boring stuff he always says without anything new. I feel there could have been another force at work, which we can discus another time .

Anyways, the market pierced those resistance levels and I’m sure a ton of traders have switch their view on the market from bearish to bullish. While I prefer to trade with the trend I can’t help but feel this market is still range bound, which is why I am still bearish at these shakeout levels. The SP500 did break resistance BUT the following candle did not close above the breakout candles high to confirm the move.

That said, the market is now trading back down at support and the next couple of days I’m sure will shed some like on the direction.

20 Year Bonds – TLT Fund, Daily Chart

We have seen the bond price pullback in a bull flag formation. It touched support before bouncing to break short term resistance as it looks to have started another rally. The chart below overlays both the candlesticks of the bond price and the SP500 which is the white line. You will notice they have an inverse relationship. If bond prices continue to rally then lower SP500 could start to rollover.

US Dollar – UUP Fund, Daily Chart

The dollar has fallen sharply the past 10 trading session and it looks to be oversold for a couple reasons. The past couple days the price has dropped straight down and gapped lower. This recent drop has reached a gap window which will act as support and could provide a tradable bounce in the coming days depending how things unfold.

In short, the SP500 is flirting with resistance and has yet to confirm the breakout. Bond prices look to be headed higher which will makes me think equities could start to sell off any day now… It’s also important to note that the big banks GS and JPM shares have been under pressure and they tend to lead the broad market. Another point to add is the fact the oil has not rallied even though the dollar dropped like a rock? What happens if the dollar bounces? Could oil finally start its next leg down?

Gold and silver continue their steady grind up. The price action reminds me of the 2009 Nov –Dec move. Once that train de-rails its going to have a sharp correction…

You can get my ETF and Commodity Trading Signals if you become a subscriber of my newsletter. These free reports will continue to come on a weekly basis; however, instead of covering 3-5 investments at a time, I’ll be covering only 1. Newsletter subscribers will be getting more analysis that’s actionable. I’ve also decided to add video analysis as it allows me toe get more into across to you quicker and is more educational, and I’ll be covering more of the market to include currencies, bonds and sectors. Before everyone’s emails were answered personally, but now my focus is on building a strong group of traders and they will receive direct personal responses regarding trade ideas and analysis going forward.

Let the volatility and volume return!

Chris Vermeulen....The Gold And Oil Guy.Com

Get More Free Reports and Trade Ideas Here for Free: FREE SIGN UP

Share

It’s been a wild ride the past few days OptionsX, Obama and FOMC comments. Seems like everyone is waiting to see what the market is going to do going forward at this pivotal point…

Since the market topped in April and has since been trading sideways in this rather large range, everyone has small positions at work but waiting for a decisive move before fully committing to one side. There could be a few opportunities in the coming days using bonds, the dollar and the SP500 if all goes well which I explain below.

Lets take a look at the charts.....

SP500 – SPY ETF, Daily Chart

There has been a lot of talk about a sharp rally if the SP500 could break the 1130 level or the neckline everyone is talking about. Well this week Obama was on TV and the market rallied into that, then again after. I don’t really thing investors or traders were buying things up as he said the same boring stuff he always says without anything new. I feel there could have been another force at work, which we can discus another time .

Anyways, the market pierced those resistance levels and I’m sure a ton of traders have switch their view on the market from bearish to bullish. While I prefer to trade with the trend I can’t help but feel this market is still range bound, which is why I am still bearish at these shakeout levels. The SP500 did break resistance BUT the following candle did not close above the breakout candles high to confirm the move.

That said, the market is now trading back down at support and the next couple of days I’m sure will shed some like on the direction.

20 Year Bonds – TLT Fund, Daily Chart

We have seen the bond price pullback in a bull flag formation. It touched support before bouncing to break short term resistance as it looks to have started another rally. The chart below overlays both the candlesticks of the bond price and the SP500 which is the white line. You will notice they have an inverse relationship. If bond prices continue to rally then lower SP500 could start to rollover.

US Dollar – UUP Fund, Daily Chart

The dollar has fallen sharply the past 10 trading session and it looks to be oversold for a couple reasons. The past couple days the price has dropped straight down and gapped lower. This recent drop has reached a gap window which will act as support and could provide a tradable bounce in the coming days depending how things unfold.

In short, the SP500 is flirting with resistance and has yet to confirm the breakout. Bond prices look to be headed higher which will makes me think equities could start to sell off any day now… It’s also important to note that the big banks GS and JPM shares have been under pressure and they tend to lead the broad market. Another point to add is the fact the oil has not rallied even though the dollar dropped like a rock? What happens if the dollar bounces? Could oil finally start its next leg down?

Gold and silver continue their steady grind up. The price action reminds me of the 2009 Nov –Dec move. Once that train de-rails its going to have a sharp correction…

You can get my ETF and Commodity Trading Signals if you become a subscriber of my newsletter. These free reports will continue to come on a weekly basis; however, instead of covering 3-5 investments at a time, I’ll be covering only 1. Newsletter subscribers will be getting more analysis that’s actionable. I’ve also decided to add video analysis as it allows me toe get more into across to you quicker and is more educational, and I’ll be covering more of the market to include currencies, bonds and sectors. Before everyone’s emails were answered personally, but now my focus is on building a strong group of traders and they will receive direct personal responses regarding trade ideas and analysis going forward.

Let the volatility and volume return!

Chris Vermeulen....The Gold And Oil Guy.Com

Get More Free Reports and Trade Ideas Here for Free: FREE SIGN UP

Share

Monday, September 20, 2010

SP 500 Fakeout & Market Trend

From Chris Vermeulen, The Gold and Oil Guy....

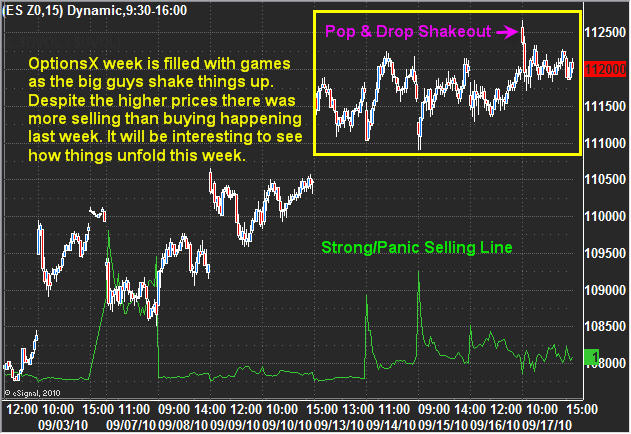

I think it’s safe to say that everyone knows the markets are manipulated… but during options expiry week we tend to see prices move beyond key resistance and support levels during times of light volume which triggers/shakes traders out of their positions.

Trading during low volume sessions Pre/Post holidays for swing traders or between 11:30am – 3:00pm ET for day traders tends have increased volatility and false breakouts. This happens because the market markets for individual stocks can slowly walk the prices up and down beyond short term support and resistance levels simply because there is a lack of participation in the market.

SP500 4 Hour Candlestick Chart

That being said, the chart below of the SPY (SP500 ETF) shows that last Thursday, (the day before Friday options expiry) the put call ratio was showing extreme bullishness. I also mentioned that we should expect a pop of 0.5 -2% in the next 24 hours as big guys will try to shake everyone out of their short positions (put options).

The put/call ratio indicator at the bottom of this chart is a contrarian indicator. When it shows that everyone has jumped to the bullish side, the big money knows its about time to change the direction so they can cash in at premium price levels.

SP500 60 Minute OptionsX Chart of the Week

If you look at the volume at the bottom of the chart you will see there are times where this virtually zero volume trades. The yellow high lighted section shows the overnight price surge which is very easy for the big guys to push higher as everyone sleeps.

Here is what they are doing. The light volume makes it easy to manipulate so they push it higher until key resistance is broken, then everyone who was short and had a protective stop in place will have their order executed. As the price rises, more and more stops get triggered. Also, with the rising number of traders becoming bullish from the previous session have buy orders to go long if key resistance is broken. This causes a virtually automated rally to unfold, but once the orders/buying dries up, the big guys start selling their positions at premium prices, pushing the price all the way back down to where the market closed the previous day.

In short, the big guys shook the majority of traders out of their positions Thursday night and pocketed a ridiculous amount of money. Crazy part is 99% of the public don’t even know this type of thing is happening while they sleep.

SP500 OptionsX Intraday Price Action

I thought I would show this chart as it shows the selling pressure in the market. What I find interesting about this chart is the fact there was more selling volume during options expiry week, but the prices continued to move higher.

From watching the market internals I saw the majority of traders go from bearish to bullish by the end of the week, and this really gave the big guys a huge advantage in my opinion. Each session selling volume took control with the big guys unloading bu the low volume afternoons naturally brought prices up again as more and more traders became bullish each session. This happened all week and Thursday night it looks as though they let the price rise allowing the key resistance level to be broken which caused a surge of buying which they could selling into. So what’s next…

SP500 / Broad Market Trading Conclusion:

In short, the market looks toppy and if all goes well, last weeks overnight shakeout just may have been a top. This week will start off slow and most likely with light volume until Wednesday. During light volume times, keep trading positions smaller than normal and remember there is a neutral/upward bias associated with light volume.

You can get my ETF and Commodity Trading Signals if you become a subscriber of my newsletter. These free reports will continue to come on a weekly basis; however, instead of covering 2-4 investments at a time, I’ll only be covering only one. Newsletter subscribers will be getting more analysis that’s actionable. I’ve also decided to add video analysis per customer’s request, and I’ll be covering more of the market to include currencies, bonds and sectors. Before everyone’s emails were answered personally, but now my focus is on building a strong group of newsletter traders and they will receive direct personal responses regarding trade ideas and analysis going forward. Let the volatility and volume return!

Chris Vermeulen

Get More Free Reports and Trade Ideas Here for Free: FREE SIGN UP

Share

Labels:

etf alerts,

etf trading,

Gold Trading,

Oil ETF Analysis,

SPY ETF Trading

Thursday, September 9, 2010

Dollar Looks to Have Found Support at the March/April Lows

From guest blogger Chris Vermeulen.....

The US Dollar looks to have found support at the March/April lows and has put in a very solid rally. If the chart pattern is correct then it looks as though the dollar will breakout to the upside and run to $24.75 area. The relationship between the dollar and the precious metals sector is generally inverse, meaning if the dollar rallies both gold and stocks should fall.

I hope my bi-weekly trend reports helps shed some light on the market for you. My trading alerts and frequent updates are reserved only for subscribers, so if you would like more trading analysis, updates and trades please join me at The Gold And Oil Guy.Com

Just click here for your FREE trend analysis of the U.S. Dollar ETF UUP

Share

The US Dollar looks to have found support at the March/April lows and has put in a very solid rally. If the chart pattern is correct then it looks as though the dollar will breakout to the upside and run to $24.75 area. The relationship between the dollar and the precious metals sector is generally inverse, meaning if the dollar rallies both gold and stocks should fall.

I hope my bi-weekly trend reports helps shed some light on the market for you. My trading alerts and frequent updates are reserved only for subscribers, so if you would like more trading analysis, updates and trades please join me at The Gold And Oil Guy.Com

Just click here for your FREE trend analysis of the U.S. Dollar ETF UUP

Share

Friday, September 3, 2010

Learn How to Create Synthetic SPX Equity Positions Using Options

From guest blogger J.W. Jones....

For most equity traders, the S&P and/or the Dow are watched quite closely. While these indices are usually just as important to option traders, the volatility index is generally closely monitored as well. There are a variety of volatility indices to watch, but most traders look at the S&P volatility index which is commonly referred to as “The VIX.”

I spend a lot of time watching the S&P E-mini’s as well as watching the VIX. Recently I have been using a variation of what most option traders call synthetic stock positions. Through the use of options, a competent trader can sustain similar returns with far less capital than what would be required to own the stock outright, even if the equity trader was using a margin account.

The traditional structure of a synthetic long stock position involves buying a call and selling a put at the same strike price and expiration date. If an option trader is leaning long, he/she would buy a call and sell the put, likewise if the option trader is leaning short then the put is purchased and the call is sold. Typically, the trade utilizes options that are near-the-money or slightly in-the money.

For those who remember high school algebra, the mathematical expression of this relationship is S=C-P. The variables are defined as S=stock, C=call, and P=put. Using tenth grade algebraic rearrangements of this equation, the various equivalency relationships can easily be determined.

Before I go any further, naysayers will point out that selling a naked call offers unlimited risk to an option trader as stocks theoretically can rise to infinity. It is true, the naked call position is extremely risky and a naked put position carries significant risk as well, but alas, there are ways to mitigate that risk. So before you start crying about how much risk a trade like this is undertaking, please continue reading.

However, before we begin detailed discussions, remember that the risk of option positions is appropriately gauged against the yardstick of equivalent equity positions. Many traders have made the logical error of considering option positions constructed with the same capital against what they think is the same equity position. This is a fundamental error in logic. The appropriate yardstick by which risk is gauged is delta equivalent positions.

For many who are beginning to trade options or those that do not have enough capital, option brokers will not allow option traders to sell naked calls or puts. There is a way around this little issue; the answer lies within a credit spread which will mitigate the risk of selling a call or put naked. A credit spread is an option strategy where a trader sells a call or put, and then purchases a call or put that expires the same month/week that is further out of the money. The difference represents a credit to the traders account and the maximum gain they can achieve on the position.

I am relatively risk averse, so the structure I typically use if I want to get long involves buying a call, selling a put at the same strike, and then purchasing an out-of-the-money put a few strikes lower. The purchase of the put a few strikes lower reduces the risk that is borne by selling the put naked. Below is an example of this trade using the September SPY options. In the example, I will assume that I have a short bias and that I am using the SPY Tuesday close around $105.30/share.

Option trading is unique due to the complex nature that operates behind the scenes mathematically which incorporates the effects of not only price, but also time and implied volatility. Options can be extremely technical, so in response to that most option traders utilize charting software that helps visualize how a specific strategy will react to price. The chart above is a visual representation of the example mentioned. The white line represents profit and loss on September 1st. The red line represents profit or loss at option expiration.

In order to illustrate the credit spread portion of the trade, note that the SPY 105 call would be sold for $250 ($2.50 per option) and the 106 SPY call was purchased for $198 ($1.98). The $52 difference represents a credit to the trader. Instead of $52 dollars hitting your trading account, option brokers utilize the $52 to reduce the cost of the total trade. In this case, the SPY 105 put was purchased for $209 ($2.09). Thus the $52 credit reduces the cost of the SPY 105 put by $52, meaning that the 105 put was essentially purchased for $157 ($1.57).

The reason the maximum risk is $257 dollars on this trade is due to the fact that if price closes at option expiration above $106/share, the trader would lose an additional $100 dollars as the spread would be upside down. $1.57 + $1.00 = $2.57 – Thus $257 is the maximum risk on this particular trade. Regardless of how high SPY climbs, at option expiration the most the option trader will lose is $257 on this specific trade, commissions not included.

The position becomes profitable around $105.15 so we are not perfectly aligned as a trader that shorted the SPY using common stock. The equity trader will capture more profit overall, but the option position will act quite similar to owning the actual stock. This is not to say that the synthetic stock position does not have risk, the risk it is exposed to is different from the equity trader. The biggest threat that a synthetic stock position like this has is Theta risk, or time decay risk. As time passes, SPY would have to move further and further to the downside to create profit for the option trader. In order to illustrate this risk, for this trade to be profitable at option expiration SPY would have to be below $103.44 just to break even.

This strategy is not new nor is it revolutionary. It is susceptible to market risk, Theta risk, and volatility risk should volatility spike or decline rapidly. This is not a trade that should be utilized for an extended period of time. This type of trade should be used similarly to a swing trade. It works well for traders who do not have the capital to trade the SPY ETF or are unable to control enough stock to make trading it worthwhile. Through the use of the inherent leverage built into options, one could achieve a return similar to an equity trader that owned 350 shares of SPY while having roughly $1,028 of maximum risk. This is not a strategy for beginners nor is it a strategy that should be employed for long periods of time, but in the right circumstances it can produce outsized profits with a fixed amount of risk.

Just click here if you would like to receive J.W. Jones free educational options articles and trading signals.

Visit INO TV Options Channel

Share

For most equity traders, the S&P and/or the Dow are watched quite closely. While these indices are usually just as important to option traders, the volatility index is generally closely monitored as well. There are a variety of volatility indices to watch, but most traders look at the S&P volatility index which is commonly referred to as “The VIX.”

I spend a lot of time watching the S&P E-mini’s as well as watching the VIX. Recently I have been using a variation of what most option traders call synthetic stock positions. Through the use of options, a competent trader can sustain similar returns with far less capital than what would be required to own the stock outright, even if the equity trader was using a margin account.

The traditional structure of a synthetic long stock position involves buying a call and selling a put at the same strike price and expiration date. If an option trader is leaning long, he/she would buy a call and sell the put, likewise if the option trader is leaning short then the put is purchased and the call is sold. Typically, the trade utilizes options that are near-the-money or slightly in-the money.

For those who remember high school algebra, the mathematical expression of this relationship is S=C-P. The variables are defined as S=stock, C=call, and P=put. Using tenth grade algebraic rearrangements of this equation, the various equivalency relationships can easily be determined.

Before I go any further, naysayers will point out that selling a naked call offers unlimited risk to an option trader as stocks theoretically can rise to infinity. It is true, the naked call position is extremely risky and a naked put position carries significant risk as well, but alas, there are ways to mitigate that risk. So before you start crying about how much risk a trade like this is undertaking, please continue reading.

However, before we begin detailed discussions, remember that the risk of option positions is appropriately gauged against the yardstick of equivalent equity positions. Many traders have made the logical error of considering option positions constructed with the same capital against what they think is the same equity position. This is a fundamental error in logic. The appropriate yardstick by which risk is gauged is delta equivalent positions.

For many who are beginning to trade options or those that do not have enough capital, option brokers will not allow option traders to sell naked calls or puts. There is a way around this little issue; the answer lies within a credit spread which will mitigate the risk of selling a call or put naked. A credit spread is an option strategy where a trader sells a call or put, and then purchases a call or put that expires the same month/week that is further out of the money. The difference represents a credit to the traders account and the maximum gain they can achieve on the position.

I am relatively risk averse, so the structure I typically use if I want to get long involves buying a call, selling a put at the same strike, and then purchasing an out-of-the-money put a few strikes lower. The purchase of the put a few strikes lower reduces the risk that is borne by selling the put naked. Below is an example of this trade using the September SPY options. In the example, I will assume that I have a short bias and that I am using the SPY Tuesday close around $105.30/share.

Option trading is unique due to the complex nature that operates behind the scenes mathematically which incorporates the effects of not only price, but also time and implied volatility. Options can be extremely technical, so in response to that most option traders utilize charting software that helps visualize how a specific strategy will react to price. The chart above is a visual representation of the example mentioned. The white line represents profit and loss on September 1st. The red line represents profit or loss at option expiration.

In order to illustrate the credit spread portion of the trade, note that the SPY 105 call would be sold for $250 ($2.50 per option) and the 106 SPY call was purchased for $198 ($1.98). The $52 difference represents a credit to the trader. Instead of $52 dollars hitting your trading account, option brokers utilize the $52 to reduce the cost of the total trade. In this case, the SPY 105 put was purchased for $209 ($2.09). Thus the $52 credit reduces the cost of the SPY 105 put by $52, meaning that the 105 put was essentially purchased for $157 ($1.57).

The reason the maximum risk is $257 dollars on this trade is due to the fact that if price closes at option expiration above $106/share, the trader would lose an additional $100 dollars as the spread would be upside down. $1.57 + $1.00 = $2.57 – Thus $257 is the maximum risk on this particular trade. Regardless of how high SPY climbs, at option expiration the most the option trader will lose is $257 on this specific trade, commissions not included.

The position becomes profitable around $105.15 so we are not perfectly aligned as a trader that shorted the SPY using common stock. The equity trader will capture more profit overall, but the option position will act quite similar to owning the actual stock. This is not to say that the synthetic stock position does not have risk, the risk it is exposed to is different from the equity trader. The biggest threat that a synthetic stock position like this has is Theta risk, or time decay risk. As time passes, SPY would have to move further and further to the downside to create profit for the option trader. In order to illustrate this risk, for this trade to be profitable at option expiration SPY would have to be below $103.44 just to break even.

This strategy is not new nor is it revolutionary. It is susceptible to market risk, Theta risk, and volatility risk should volatility spike or decline rapidly. This is not a trade that should be utilized for an extended period of time. This type of trade should be used similarly to a swing trade. It works well for traders who do not have the capital to trade the SPY ETF or are unable to control enough stock to make trading it worthwhile. Through the use of the inherent leverage built into options, one could achieve a return similar to an equity trader that owned 350 shares of SPY while having roughly $1,028 of maximum risk. This is not a strategy for beginners nor is it a strategy that should be employed for long periods of time, but in the right circumstances it can produce outsized profits with a fixed amount of risk.

Just click here if you would like to receive J.W. Jones free educational options articles and trading signals.

Visit INO TV Options Channel

Share

Thursday, September 2, 2010

Are You up on this Forex 'Flaw'

While researching new ways to save time trading Forex (without sacrificing pips), this trader kind of stumbled upon 2 'discoveries' that may surprise you.

The first one has to do with a 'flaw' in how 90% or more of Forex traders think about trading these markets. It's deceptively simple....yet it led him to develop a pretty unusual technique around 'scalping' the 'sweet spots' of the best Forex markets.

Watch this brand new video he just recorded that reveals these discoveries, along with an unusual 'scalping' technique.

Good Trading,

Ray C. Parrish @ Forex market Club

p.s. If you really, really enjoy staring at your computer all day long day trading every nook & cranny of the markets, then you might not like this video, because it shows you how to spend LESS time trading and MORE time 'having a life'.

Share

The first one has to do with a 'flaw' in how 90% or more of Forex traders think about trading these markets. It's deceptively simple....yet it led him to develop a pretty unusual technique around 'scalping' the 'sweet spots' of the best Forex markets.

Watch this brand new video he just recorded that reveals these discoveries, along with an unusual 'scalping' technique.

Good Trading,

Ray C. Parrish @ Forex market Club

p.s. If you really, really enjoy staring at your computer all day long day trading every nook & cranny of the markets, then you might not like this video, because it shows you how to spend LESS time trading and MORE time 'having a life'.

Share

Subscribe to:

Posts (Atom)