![]()

Two years ago, my friend Mohamed El-Erian and I were on the stage at my Strategic Investment Conference. Naturally we were discussing currencies in the global economy, and I asked him about currency wars. He smiled and said to me, “John, we don’t talk about currency wars in polite circles. More like currency disagreements” (or some word to that effect).

This week I note that he actually uses the words

currency war in an essay he wrote for Project Syndicate:

Yet the benefits of the dollar’s rally are far from guaranteed, for both economic and financial reasons. While the US economy is more resilient and agile than its developed counterparts, it is not yet robust enough to be able to adjust smoothly to a significant shift in external demand to other countries. There is also the risk that, given the role of the ECB and the Bank of Japan in shaping their currencies’ performance, such a shift could be characterized as a “currency war” in the US Congress, prompting a retaliatory policy response.

This is a short treatise, but as usual with Mohamed’s writing, it’s very thought provoking. Definitely

Outside the Box material.

And for a two-part

Outside the Box I want to take the unusual step of including an op-ed piece that you might not have seen, from the

Wall Street Journal, called “How to Distort Income Inequality,” by Phil Gramm and Michael Solon. They cite research I’ve seen elsewhere which shows that the work by Thomas Piketty cherry-picks data and ignores total income and especially how taxes distort the data. That is not to say that income inequality does not exist and that we should not be cognizant and concerned, but we need to plan policy based on a firm grasp of reality and not overreact because of some fantasy world created by social provocateur academicians.

This weeks new video "How you can Profit from ETFs on the Unexpected Move in the Dollar".....Just Click Here

The calls for income redistribution from socialists and liberals based on Piketty’s work are clearly misguided and will further distort income inequality in ways that will only reduce total global productivity and growth.

I’m in New York today at an institutional fund manager conference where I had the privilege of hearing my good friend Ian Bremmer take us around the world on a geopolitical tour. Ian was refreshingly optimistic, or at least sanguine, about most of the world over the next few years. Lots of potential problems, of course, but he thinks everything should turn out fine – with the notable exception of Russia, where he is quite pessimistic.

A shirtless Vladimir Putin was the scariest thing on his geopolitical radar. As he spoke, Russia was clearly putting troops and arms into eastern Ukraine. Why would you do that if you didn’t intend to go further? Ian worried openly about Russia’s extending a land bridge all the way to Crimea and potentially even to Odessa, which is the heart of economic Ukraine, along with the Kiev region. It would basically make Ukraine ungovernable.

I thought Putin’s sadly grim and memorable line that “The United States is prepared to fight Russia to the last Ukrainian” pretty much sums up the potential for a US or NATO response. Putin agreed to a cease-fire and assumed that sanctions would start to be lifted. When there was no movement on sanctions, he pretty much went back to square one. He has clearly turned his economic attention towards China.

Both Ian Bremmer and Mohamed El Erian will be at my Strategic Investment Conference next year, which will again be in San Diego in the spring, April 28-30. Save the dates in your calendar as you do not want to miss what is setting up to be a very special conference. We will get more details to you soon.

It is a very pleasant day here in New York, and I was able to avoid taxis and put in about six miles of pleasant walking. (Sadly, it is supposed to turn cold tomorrow.) I’ve gotten used to getting around in cities and slipping into the flow of things, but there was a time when I felt like the country mouse coming to the city. As I walked past St. Bart’s today I was reminded of an occasion when your humble analyst nearly got himself in serious trouble.

There is a very pleasant little outdoor restaurant at St. Bartholomew’s Episcopal Church, across the street from the side entrance of the Waldorf-Astoria. It was a fabulous day in the spring, and I was having lunch with my good friend Barry Ritholtz. The president (George W.) was in town and staying at the Waldorf. His entourage pulled up and Barry pointed and said, “Look, there’s the president.”

We were at the edge of the restaurant, so I stood up to see if I could see George. The next thing I know, Barry’s hand is on my shoulder roughly pulling me back into my seat. “Sit down!” he barked. I was rather confused – what faux pas I had committed? Barry pointed to two rather menacing, dark-suited figures who were glaring at me from inside the restaurant.

“They were getting ready to shoot you, John! They had their hands inside their coats ready to pull guns. They thought you were going to do something to the president!”

This was New York not too long after 9/11. The memory is fresh even today. Now, I think I would know better than to stand up with the president coming out the side door across the street. But back then I was still just a country boy come to the big city.

Tomorrow night I will have dinner with Barry and Art Cashin and a few other friends at some restaurant which is supposedly famous for a mob shooting back in the day. Art will have stories, I am sure.

It is time to go sing for my supper, and I will try not to keep the guests from enjoying what promises to be a fabulous meal from celebrity chef Cyrille Allannic. After Ian’s speech, I think I will be nothing but sweetness and light, just a harmless economic entertainer. After all, what could possibly go really wrong with the global economy, when you’re being wined and dined at the top of New York? Have a great week.

Stay Ahead of the Latest Tech News and Investing Trends...

Each day, you get the three tech news stories with the biggest potential impact.

The Return of the Dollar

By Mohamed El-Erian

Project Syndicate, Nov. 13, 2014

The U.S. dollar is on the move. In the last four months alone, it has

soared by more than 7% compared with a basket of more than a dozen global currencies, and by even more against the euro and the Japanese yen. This dollar rally, the result of genuine economic progress and divergent policy developments, could contribute to the “rebalancing” that has long eluded the world economy. But that outcome is far from guaranteed, especially given the related risks of financial instability.

Two major factors are currently working in the dollar’s favor, particularly compared to the euro and the yen. First, the United States is consistently outperforming Europe and Japan in terms of economic growth and dynamism – and will likely continue to do so – owing not only to its economic flexibility and entrepreneurial energy, but also to its more decisive policy action since the start of the global financial crisis.

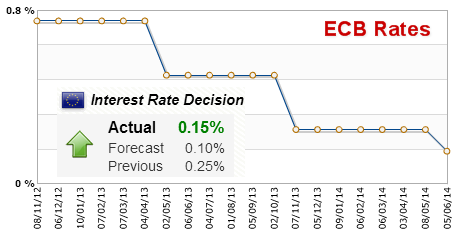

Second, after a period of alignment, the monetary policies of these three large and systemically important economies are diverging, taking the world economy from a multi-speed trajectory to a multi-track one. Indeed, whereas the US Federal Reserve terminated its large-scale securities purchases, known as “quantitative easing” (QE), last month, the Bank of Japan and the European Central Bank recently announced the expansion of their monetary-stimulus programs. In fact, ECB President Mario Draghi signaled a willingness to expand his institution’s balance sheet by a massive €1 trillion ($1.25 trillion).

With higher US market interest rates attracting additional capital inflows and pushing the dollar even higher, the currency’s revaluation would appear to be just what the doctor ordered when it comes to catalyzing a long-awaited global rebalancing – one that promotes stronger growth and mitigates deflation risk in Europe and Japan. Specifically, an appreciating dollar improves the price competitiveness of European and Japanese companies in the US and other markets, while moderating some of the structural deflationary pressure in the lagging economies by causing import prices to rise.

Yet the benefits of the dollar’s rally are far from guaranteed, for both economic and financial reasons. While the US economy is more resilient and agile than its developed counterparts, it is not yet robust enough to be able to adjust smoothly to a significant shift in external demand to other countries. There is also the risk that, given the role of the ECB and the Bank of Japan in shaping their currencies’ performance, such a shift could be characterized as a “currency war” in the US Congress, prompting a retaliatory policy response.

Furthermore, sudden large currency moves tend to translate into financial-market instability. To be sure, this risk was more acute when a larger number of emerging-economy currencies were pegged to the U.S. dollar, which meant that a significant shift in the dollar’s value would weaken other countries’ balance of payments position and erode their international reserves, thereby undermining their creditworthiness. Today, many of these countries have adopted more flexible exchange-rate regimes, and quite a few retain adequate reserve holdings.

But a new issue risks bringing about a similarly problematic outcome: By repeatedly repressing financial-market volatility over the last few years, central-bank policies have inadvertently encouraged excessive risk-taking, which has pushed many financial-asset prices higher than economic fundamentals warrant. To the extent that continued currency-market volatility spills over into other markets – and it will – the imperative for stronger economic fundamentals to validate asset prices will intensify.

This is not to say that the currency re-alignment that is currently underway is necessarily a problematic development; on the contrary, it has the potential to boost the global economy by supporting the recovery of some of its most challenged components. But the only way to take advantage of the re-alignment’s benefits, without experiencing serious economic disruptions and financial-market volatility, is to introduce complementary growth-enhancing policy adjustments, such as accelerating structural reforms, balancing aggregate demand, and reducing or eliminating debt overhangs.

After all, global growth, at its current level, is inadequate for mere redistribution among countries to work. Overall global GDP needs to increase.

The US dollar’s resurgence, while promising, is only a first step. It is up to governments to ensure that the ongoing currency re-alignment supports a balanced, stable, and sustainable economic recovery. Otherwise, they may find themselves again in the unpleasant business of mitigating financial instability.

How to Distort Income Inequality

By Phil Gramm and Michael Solon

Wall Street Journal, Nov. 11, 2014

The Piketty-Saez data ignore changes in tax law and fail to count noncash compensation and Social Security benefits.

What the hockey-stick portrayal of global temperatures did in bringing a sense of crisis to the issue of global warming is now being replicated in the controversy over income inequality, thanks to a now-famous

study by Thomas Piketty and Emmanuel Saez, professors of economics at the Paris School of Economics and the University of California, Berkeley, respectively. Whether the issue is climate change or income inequality, however, problems with the underlying data significantly distort the debate.

The chosen starting point for the most-quoted part of the Piketty-Saez study is 1979. In that year the inflation rate was 13.3%, interest rates were 15.5% and the poverty rate was rising, but economic misery was distributed more equally than in any year since. That misery led to the election of Ronald Reagan, whose economic policies helped usher in 25 years of lower interest rates, lower inflation and high economic growth. But Messrs. Piketty and Saez tell us it was also a period where the rich got richer, the poor got poorer and only a relatively small number of Americans benefited from the economic booms of the Reagan and Clinton years.

If that dark picture doesn’t sound like the country you lived in, that’s because it isn’t. The Piketty-Saez study looked only at pretax cash market income. It did not take into account taxes. It left out noncash compensation such as employer-provided health insurance and pension contributions. It left out Social Security payments, Medicare and Medicaid benefits, and more than 100 other means-tested government programs. Realized capital gains were included, but not the first $500,000 from the sale of one’s home, which is tax-exempt. IRAs and 401(k)s were counted only when the money is taken out in retirement. Finally, the Piketty-Saez data are based on individual tax returns, which ignore, for any given household, the presence of multiple earners.

And now, thanks to a new

study in the Southern Economic Journal, we know what the picture looks like when the missing data are filled in. Economists Philip Armour and Richard V. Burkhauser of Cornell University and Jeff Larrimore of Congress’s Joint Committee on Taxation expanded the Piketty-Saez income measure using census data to account for all public and private in-kind benefits, taxes, Social Security payments and household size.

The result is dramatic. The bottom quintile of Americans experienced a 31% increase in income from 1979 to 2007 instead of a 33% decline that is found using a Piketty-Saez market-income measure alone. The income of the second quintile, often referred to as the working class, rose by 32%, not 0.7%. The income of the middle quintile, America’s middle class, increased by 37%, not 2.2%.

By omitting Social Security, Medicare and Medicaid, the Piketty-Saez study renders most older Americans poor when in reality most have above-average incomes. The exclusion of benefits like employer-provided health insurance, retirement benefits (except when actually paid out in retirement) and capital gains on homes misses much of the income and wealth of middle- and upper-middle income families.

Messrs. Piketty and Saez also did not take into consideration the effect that tax policies have on how people report their incomes. This leads to major distortions. The bipartisan tax reform of 1986 lowered the highest personal tax rate to 28% from 50%, but the top corporate-tax rate was reduced only to 34%. There was, therefore, an incentive to restructure businesses from C-Corps to subchapter S corporations, limited liability corporations, partnerships and proprietorships, where the same income would now be taxed only once at a lower, personal rate. As businesses restructured, what had been corporate income poured into personal income-tax receipts.

So Messrs. Piketty and Saez report a 44% increase in the income earned by the top 1% in 1987 and 1988—though this change reflected how income was taxed, not how income had grown. This change in the structure of American businesses alone accounts for roughly one-third of what they portray as the growth in the income share earned by the top 1% of earners over the entire 1979-2012 period.

An equally extraordinary distortion in the data used to measure inequality (the Gini Coefficient) has been discovered by Cornell’s Mr. Burkhauser. In 1992 the Census Bureau changed the Current Population Survey to collect more in-depth data on high-income individuals. This change in survey technique alone, causing a one-time upward shift in the measured income of high-income individuals, is the source of almost 30% of the total growth of inequality in the U.S. since 1979.

Simple statistical errors in the data account for roughly one third of what is now claimed to be a “frightening” increase in income inequality. But the weakness of the case for redistribution does not end there. America is the freest and most dynamic society in history, and freedom and equality of outcome have never coexisted anywhere at any time. Here the innovator, the first mover, the talented and the persistent win out—producing large income inequality. The prizes are unequal because in our system consumers reward people for the value they add. Some can and do add extraordinary value, others can’t or don’t.

How exactly are we poorer because

Bill Gates,

Warren Buffett and the Walton family are so rich? Mr. Gates became rich by mainstreaming computer power into our lives and in the process made us better off. Mr. Buffett’s genius improves the efficiency of capital allocation and the whole economy benefits.

Wal-Mart stretches our buying power and raises the living standards of millions of Americans, especially low-income earners. Rich people don’t “take” a large share of national income, they “bring” it. The beauty of our system is that everybody benefits from the value they bring.

Yes, income is 24% less equally distributed here than in the average of the other 34 member countries of the OECD. But OECD figures show that U.S. per capita GDP is 42% higher, household wealth is 210% higher and median disposable income is 42% higher. How many Americans would give up 42% of their income to see the rich get less?

Vast new fortunes were earned in the 25-year boom that began under Reagan and continued under Clinton. But the income of middle-class Americans rose significantly. These incomes have fallen during the Obama presidency, and not because the rich have gotten richer. They’ve fallen because bad federal policies have yielded the weakest recovery in the postwar history of America.

Yet even as the recovery continues to disappoint, the president increasingly turns to the politics of envy by demanding that the rich pay their “fair share.” The politics of envy may work here as it has worked so often in Latin America and Europe, but the economics of envy is failing in America as it has failed everywhere else.

Mr. Gramm, a former Republican senator from Texas, is a visiting scholar at the American Enterprise Institute. Mr. Solon was a budget adviser to Senate Republican Leader Mitch McConnell and is a partner of US Policy Metrics.

Like Outside the Box?

Sign up today and get each new issue delivered free to your inbox.

It's your opportunity to get the news John Mauldin thinks matters most to your finances.

Important Disclosures