The September Euro currency closed down 15 points at 1.3530 today. Prices closed nearer the session low and closed at another fresh four month low close today. Bears have the solid near term technical advantage and have gained more power this week.

The September Japanese yen closed up 33 points at .9808 today. Prices closed nearer the session high. The bears have the slight near term technical advantage.

The September Swiss franc closed down 9 points at 1.1120 today. Prices closed near mid range and closed at another four month low close today. The bears have the overall near term technical advantage.

The September Canadian Dollar closed up 35 points at .9180 today. Prices closed nearer the session high. The bulls today gained the slight near term technical advantage.

The September British Pound closed up 37 points at 1.6779 today. Prices closed nearer the session high today. The bulls have the slight overall near term technical advantage. Prices are in a five week old downtrend on the daily bar chart, however.

The September U.S. dollar index closed down 0.040 at 80.900 today. Prices closed near mid range today. The greenback bulls have the near term technical advantage. Prices are in a four week old uptrend on the daily bar chart.

e Mini 2.0 Success Formula.....Trade the Most Active Market in the World

Wednesday, June 11, 2014

Monday, June 9, 2014

The Lazy Mans Way To Earn a Paycheck with Options

How does an extra "paycheck" every Friday sound?

How does an extra "paycheck" every Friday sound?This little known, two step trading technique exploits a "flaw" around how most people trade options so that you have the potential to:

- Earn up to 2% every 7 days, averaging up to 30% every year.

Go here to download the step-by-step 'blueprint' that reveals how it's done, and follow along with the training video.

We think you'll be surprised.

Good Trading,

The Forex Market Club

p.s. Your total time investment with this technique is less than 20 minutes PER WEEK, and you collect your "instant income" every Friday. See how to make your first trade here...

Labels:

forex,

income,

investment,

options,

Trading

Sunday, June 8, 2014

Are You Ready for Negative Interest Rate and Pay the Bank to Hold Your Money?

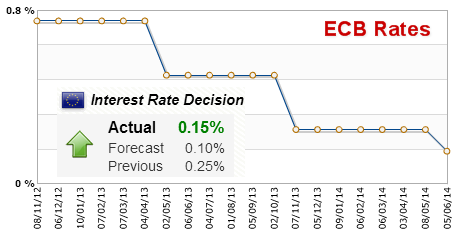

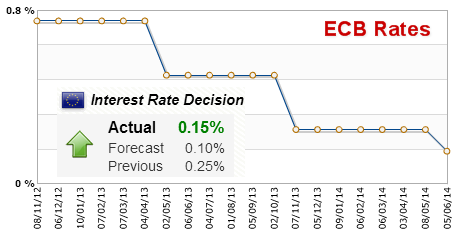

The six members of the European Central Bank (ECB) Executive Board and the 16 governors of the euro area central banks vote on where to set the rate. We watch interest rate changes closely as short term interest rates are the primary factor in currency valuation.

A higher than expected rate is positive for the EUR, while a lower than expected rate is negative for the EUR. Today (Thursday June 5th) we expected a rate cut. The cut was not as much as analysts expected which is bullish for the short term, but the rate is still declining and nearing zero, or even worse, negative territory.

A negative interest rate may sound crazy or impossible, but it's already happening in Denmark. Europe is already in a deflationary state and central banks are doing everything they can to bring about inflation by cutting rates and devaluing the euro. This will cause a ripple through multiple asset classes and will drastically alter the outcome of individuals worldwide. Just imagine if you had to pay a bank to hold your money and you do not earn any interest but rather pay interest.

People who have been saving their entire lives will get hit the hardest. Retired folks will stop earning money and start paying for all the money they hold held at banks. Individuals will go more into debt because money will be extremely cheap to borrow. Price of assets like equities, real estate, discretionary goods will rise because the cheap money everyone is borrowing will be used to buy more stuff. While all this happens everyone takes on more dept. It is a brutal spiral leading to increase debt levels, inflation and eventually bankruptcy.

If the euro dollar starts to decline at a quicker pace the U.S. dollar will likely rally. A strong dollar could affect the commodities market including gold, silver and the European stock markets. Todays rate cut led to a pop in the euro, but that is likely to be short lived. I hope this sheds some light on the markets and helps in your trading.

Chris Vermeulen

P.S. In the next few days members and myself will be looking to enter some trades based round this analysis. See Premium Trading Video & Newsletter

Sincerely,

Chris Vermeulen

Sign up for one of our Free Trading Webinars....Just Click Here!

A higher than expected rate is positive for the EUR, while a lower than expected rate is negative for the EUR. Today (Thursday June 5th) we expected a rate cut. The cut was not as much as analysts expected which is bullish for the short term, but the rate is still declining and nearing zero, or even worse, negative territory.

A negative interest rate may sound crazy or impossible, but it's already happening in Denmark. Europe is already in a deflationary state and central banks are doing everything they can to bring about inflation by cutting rates and devaluing the euro. This will cause a ripple through multiple asset classes and will drastically alter the outcome of individuals worldwide. Just imagine if you had to pay a bank to hold your money and you do not earn any interest but rather pay interest.

People who have been saving their entire lives will get hit the hardest. Retired folks will stop earning money and start paying for all the money they hold held at banks. Individuals will go more into debt because money will be extremely cheap to borrow. Price of assets like equities, real estate, discretionary goods will rise because the cheap money everyone is borrowing will be used to buy more stuff. While all this happens everyone takes on more dept. It is a brutal spiral leading to increase debt levels, inflation and eventually bankruptcy.

If the euro dollar starts to decline at a quicker pace the U.S. dollar will likely rally. A strong dollar could affect the commodities market including gold, silver and the European stock markets. Todays rate cut led to a pop in the euro, but that is likely to be short lived. I hope this sheds some light on the markets and helps in your trading.

Chris Vermeulen

P.S. In the next few days members and myself will be looking to enter some trades based round this analysis. See Premium Trading Video & Newsletter

Sincerely,

Chris Vermeulen

Sign up for one of our Free Trading Webinars....Just Click Here!

Monday, June 2, 2014

Encore Presentation....."The Insiders Guide to Growing a Small Trading Account into a Big Account"

Thanks for all the positive feedback on John Carters webinar “The Insider’s Guide to Growing a Small Trading Account into a Big Account”. Many of you have requested an encore presentation. So we are happy to say that we’ll be hosting a "live" encore webinar on this Tuesday June 3rd

You can attend at either 1:00 pm or 8:00 pm New York time. Both webinars will be live encore presentations.

Just Click Here to Register

One of the reasons we are doing this is that it turns out that a lot of traders were shut out of last week’s webinar because we were over capacity. We apologize to all that were and hope you get a seat for this week. Make sure you log on 10 minutes early to claim your seat.

So join us for a live encore presentation on Tuesday.

Click Here to Choose the 1 p.m. Webinar

Click Here to Choose the 8 p.m. Webinar

See you on Tuesday!

The Forex Market Club

Get ready for this weeks webinar by watching John's video primer "The Big Trade"

You can attend at either 1:00 pm or 8:00 pm New York time. Both webinars will be live encore presentations.

Just Click Here to Register

One of the reasons we are doing this is that it turns out that a lot of traders were shut out of last week’s webinar because we were over capacity. We apologize to all that were and hope you get a seat for this week. Make sure you log on 10 minutes early to claim your seat.

So join us for a live encore presentation on Tuesday.

Click Here to Choose the 1 p.m. Webinar

Click Here to Choose the 8 p.m. Webinar

See you on Tuesday!

The Forex Market Club

Get ready for this weeks webinar by watching John's video primer "The Big Trade"

Currency Market Summary for Monday Morning June 2nd

The June U.S. Dollar was higher overnight. Stochastics and the RSI are overbought and are turning neutral to bearish hinting that a short term top might be in or is near. Closes below the 20 day moving average crossing at 80.06 are needed to confirm that a short term top has been posted. If June extends the rally off May's low, April's high crossing at 80.77 is the next upside target. First resistance is the overnight high crossing at 80.63. Second resistance is April's high crossing at 80.77. First support is the 20 day moving average crossing at 80.06. Second support is the reaction low crossing at 79.93.

Beginner's Guide to Trading Options

The June Euro was lower overnight. Stochastics and the RSI are oversold and are turning neutral to bullish hinting that a short term low might be in or is near. Closes above the 20 day moving average crossing at 137.16 are needed to confirm that a low has been posted. If June extends the decline off May's high, the 38% retracement level of the 2013-2014 rally crossing at 135.45 is the next downside target. First resistance is the 10 day moving average crossing at 136.43. Second resistance is the 20 day moving average crossing at 137.16. First support is last Wednesday's low crossing at 136.08. Second support is the 38% retracement level of the 2013-2014 rally crossing at 135.45.

The June British Pound was lower overnight. Stochastics and the RSI are turning neutral to bullish hinting that a short term low might be in or is near. Closes above the 20 day moving average crossing at 1.6830 would confirm that a short term low has been posted. If June extends the decline off May's high, the reaction low crossing at 1.6640 is the next downside target. First resistance is the 20 day moving average crossing at 1.6830. Second resistance is the reaction high crossing at 1.6919. First support is the reaction low crossing at 1.6640. Second support is the reaction low crossing at 1.6545.

The June Swiss Franc was lower overnight and is poised to extend the decline off May's high. Stochastics and the RSI are oversold and are turning neutral to bullish hinting that a short term low might be in or is near. Closes above the 20 day moving average crossing at 1.1240 are needed to confirm that a low has been posted. If June extends the aforementioned decline, the 75% retracement level of the January-March rally crossing at 1.1160 is the next downside target. First resistance is the 10 day moving average crossing at 1.1170. Second resistance is the 20 day moving average crossing at 1.1240. First support is last Wednesday's low crossing at 1.1124. Second support is the 75% retracement level of the January-March rally crossing at 1.1086.

The June Canadian Dollar was slightly lower overnight. Stochastics and the RSI are neutral signaling that sideways to higher prices are possible near term. If June renews the rally off March's low, the 38% retracement level of the 2013-2014 decline crossing at 92.96 is the next upside target. Closes below the 20 day moving average crossing at 91.85 are needed to confirm that a short term top has been posted. First resistance is the reaction high crossing at 92.40. Second resistance is the 38% retracement level of the 2013-2014 decline crossing at 92.96. First support is the 20 day moving average crossing at 91.85. Second support is the reaction low crossing at 90.35.

The June Japanese Yen was lower overnight. Stochastics and the RSI are turning neutral to bearish signaling that sideways to lower prices are possible near term. From a broad perspective, June needs to close above .9930 or below .9598 to confirm a breakout of a four month old trading range. First resistance is May's high crossing at .9920. Second resistance is February's high crossing at .9930. First support is the reaction low crossing at .9771. Second support is May's low crossing at .9687.

This weeks free video "What's Behind the Free Trade"

Beginner's Guide to Trading Options

The June Euro was lower overnight. Stochastics and the RSI are oversold and are turning neutral to bullish hinting that a short term low might be in or is near. Closes above the 20 day moving average crossing at 137.16 are needed to confirm that a low has been posted. If June extends the decline off May's high, the 38% retracement level of the 2013-2014 rally crossing at 135.45 is the next downside target. First resistance is the 10 day moving average crossing at 136.43. Second resistance is the 20 day moving average crossing at 137.16. First support is last Wednesday's low crossing at 136.08. Second support is the 38% retracement level of the 2013-2014 rally crossing at 135.45.

The June British Pound was lower overnight. Stochastics and the RSI are turning neutral to bullish hinting that a short term low might be in or is near. Closes above the 20 day moving average crossing at 1.6830 would confirm that a short term low has been posted. If June extends the decline off May's high, the reaction low crossing at 1.6640 is the next downside target. First resistance is the 20 day moving average crossing at 1.6830. Second resistance is the reaction high crossing at 1.6919. First support is the reaction low crossing at 1.6640. Second support is the reaction low crossing at 1.6545.

The June Swiss Franc was lower overnight and is poised to extend the decline off May's high. Stochastics and the RSI are oversold and are turning neutral to bullish hinting that a short term low might be in or is near. Closes above the 20 day moving average crossing at 1.1240 are needed to confirm that a low has been posted. If June extends the aforementioned decline, the 75% retracement level of the January-March rally crossing at 1.1160 is the next downside target. First resistance is the 10 day moving average crossing at 1.1170. Second resistance is the 20 day moving average crossing at 1.1240. First support is last Wednesday's low crossing at 1.1124. Second support is the 75% retracement level of the January-March rally crossing at 1.1086.

The June Canadian Dollar was slightly lower overnight. Stochastics and the RSI are neutral signaling that sideways to higher prices are possible near term. If June renews the rally off March's low, the 38% retracement level of the 2013-2014 decline crossing at 92.96 is the next upside target. Closes below the 20 day moving average crossing at 91.85 are needed to confirm that a short term top has been posted. First resistance is the reaction high crossing at 92.40. Second resistance is the 38% retracement level of the 2013-2014 decline crossing at 92.96. First support is the 20 day moving average crossing at 91.85. Second support is the reaction low crossing at 90.35.

The June Japanese Yen was lower overnight. Stochastics and the RSI are turning neutral to bearish signaling that sideways to lower prices are possible near term. From a broad perspective, June needs to close above .9930 or below .9598 to confirm a breakout of a four month old trading range. First resistance is May's high crossing at .9920. Second resistance is February's high crossing at .9930. First support is the reaction low crossing at .9771. Second support is May's low crossing at .9687.

This weeks free video "What's Behind the Free Trade"

Labels:

bullish,

Dollar,

franc,

moving average,

pound,

resistance,

RSI,

Stochastics,

support,

trade,

Yen

Subscribe to:

Posts (Atom)